Turning Management Due Diligence Into A True Value Add

Get meaningful data, FAST.

SECTION 1 "Management DD hasn't really moved on that much in five or six years as a service offering"

The 'Old-way' that kills your investments

Slow, archaic and riddled with bias

Generic Personality Tests

that don't provide any meaningful data on the executive's ability to execute.

Cumbersome Reports

filled with excessive information that inevitably gathers dust on the G-drive.

Slow Processes

that drag on for weeks before delivering value, stalling critical decisions and risking missed opportunities.

Isolated Data

with no way to benchmark against past DDs or high-performing executives, leaving insights untapped.

The 'GIBUS-way' that powers your returns

Fast, actionable and supercharged by AI

Tailored Assessments

that use AI-driven analytics to quickly evaluate executives against PE-specific benchmarks, ensuring you back the right team.

Concise & Actionable

reports delivered in days, focusing on what matters—key risks, strengths, and growth opportunities—so you can act fast without the clutter.

Rapid Insights

delivered in under a week, empowering you to make confident investment decisions without delays that risk deal momentum.

Integrated Data

that compares leadership across your portfolio, unlocking insights to optimize every investment’s potential.

What you get when you work with GIBUS

C-Suite Partner

We partner with your team to align due diligence with your investment thesis, ensuring leadership assessments drive portfolio value and growth.

Leadership Expertise

Our experts identify the leadership strengths and risks that impact your deal, so you can build a team ready to execute your value creation plan.

AI Intelligence

We use AI to benchmark leadership across your portfolio, giving you clear insights to de-risk investments and accelerate returns.

Valuable insights, FAST.

Because time kills deals.

-

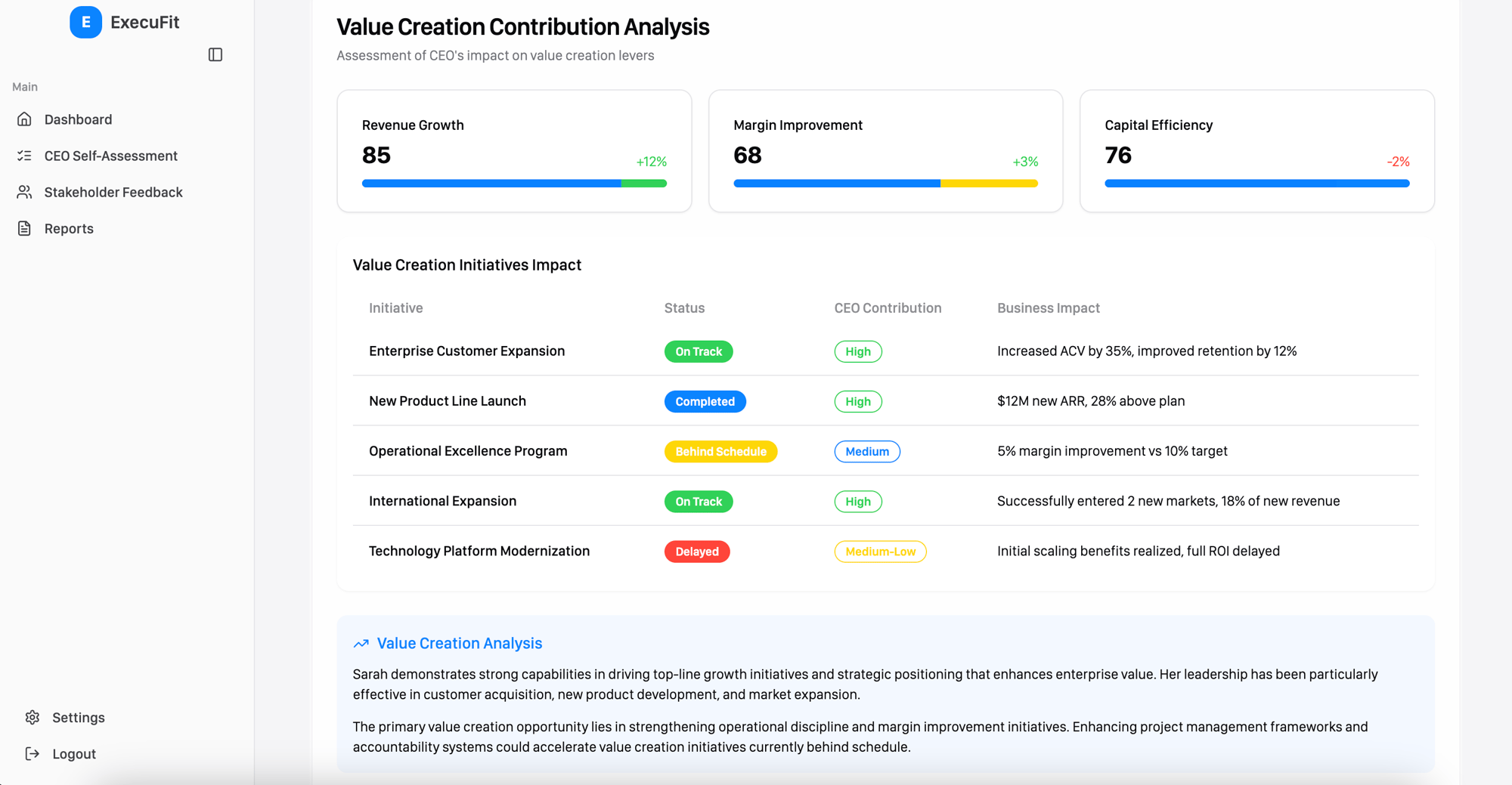

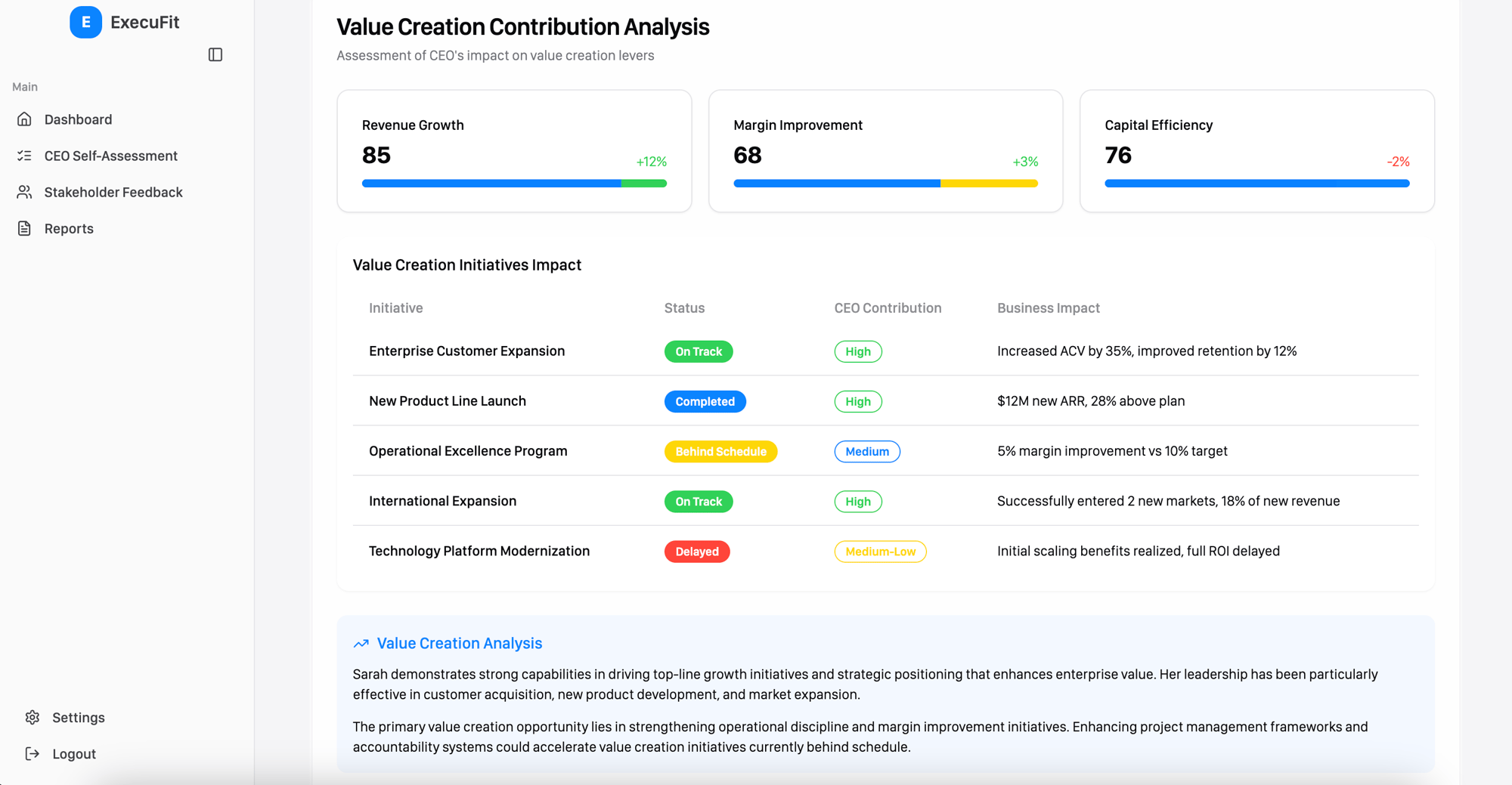

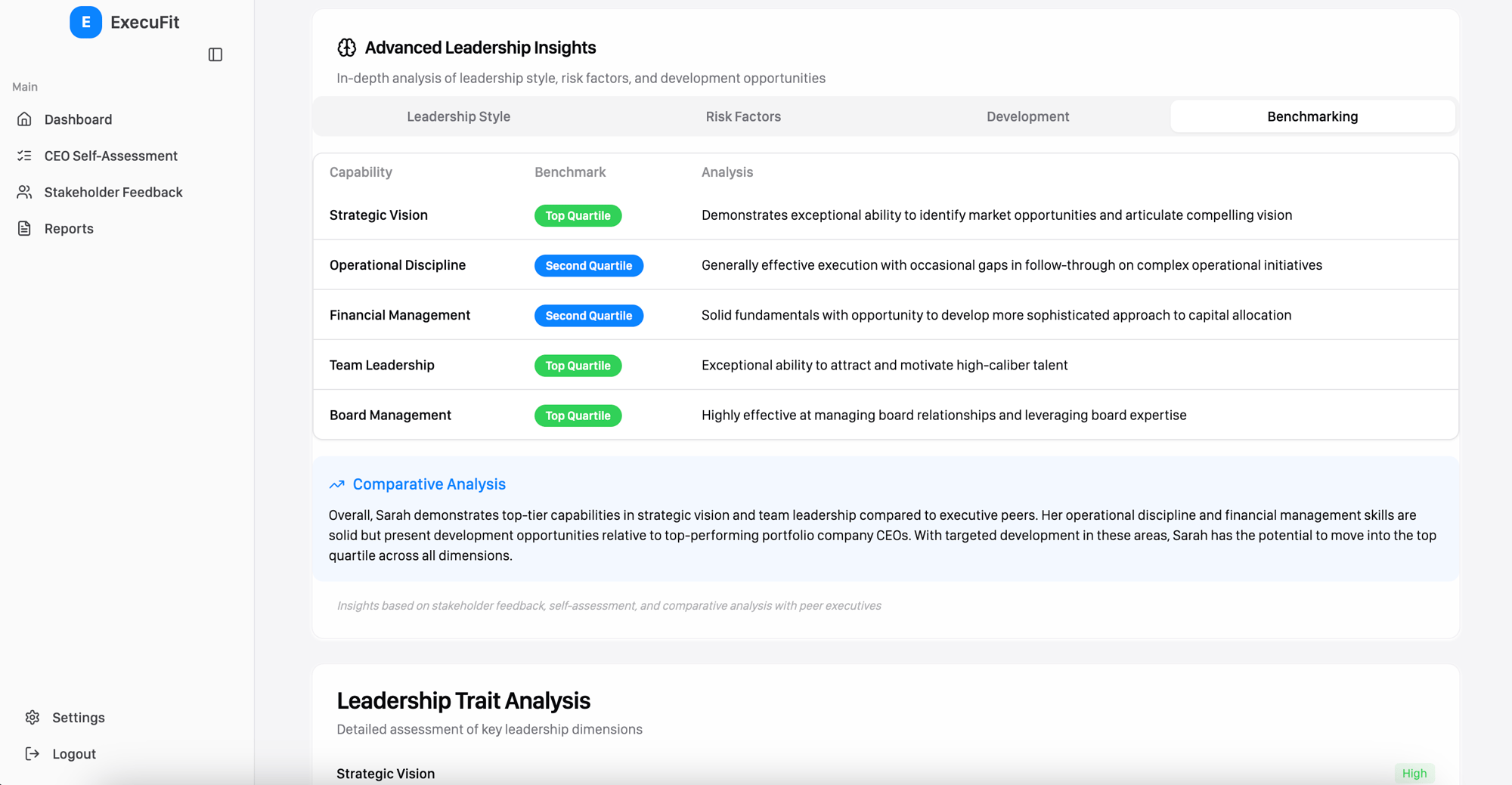

Value creation

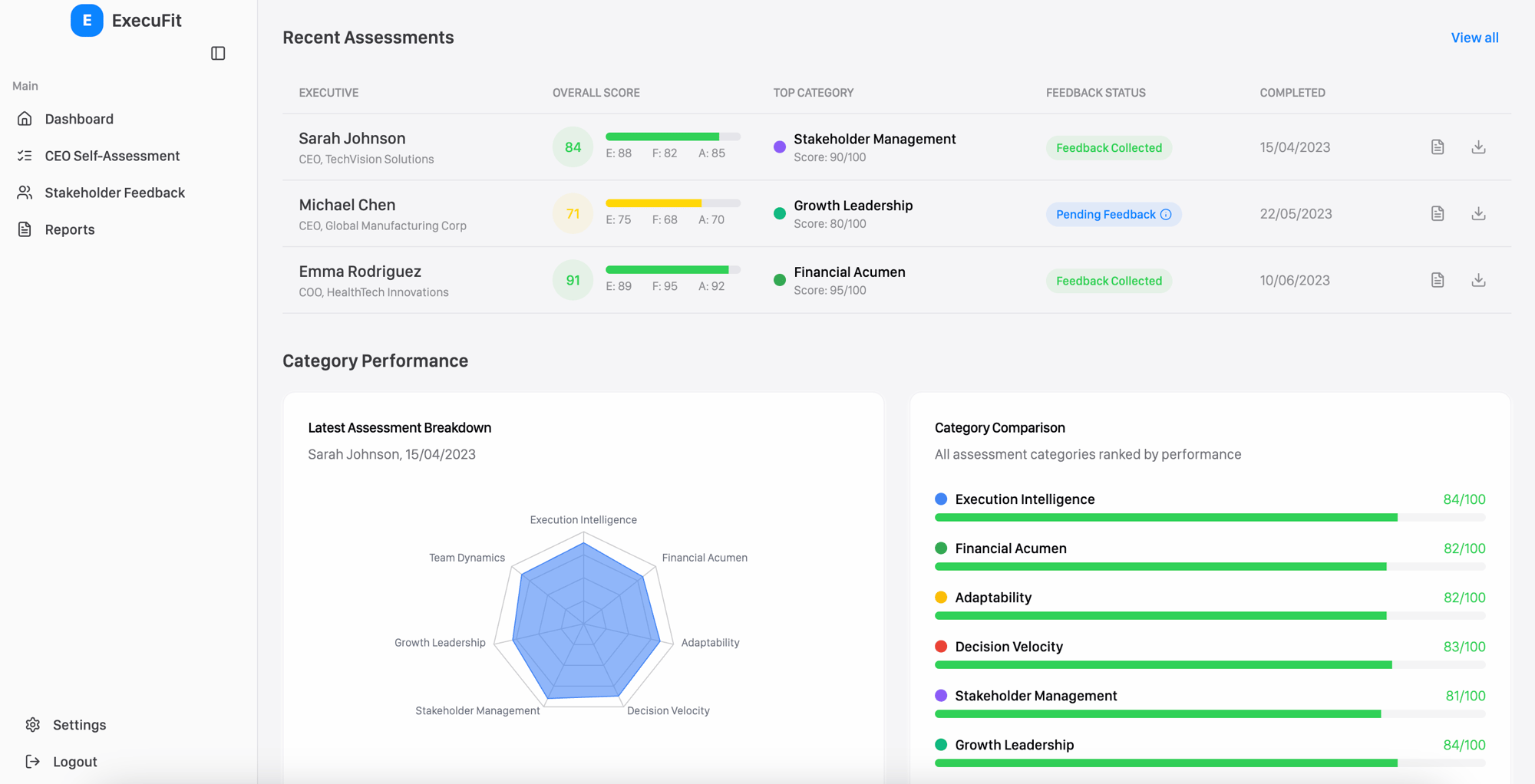

Understand the CEO's capacity to deliver on the value creation plan.

-

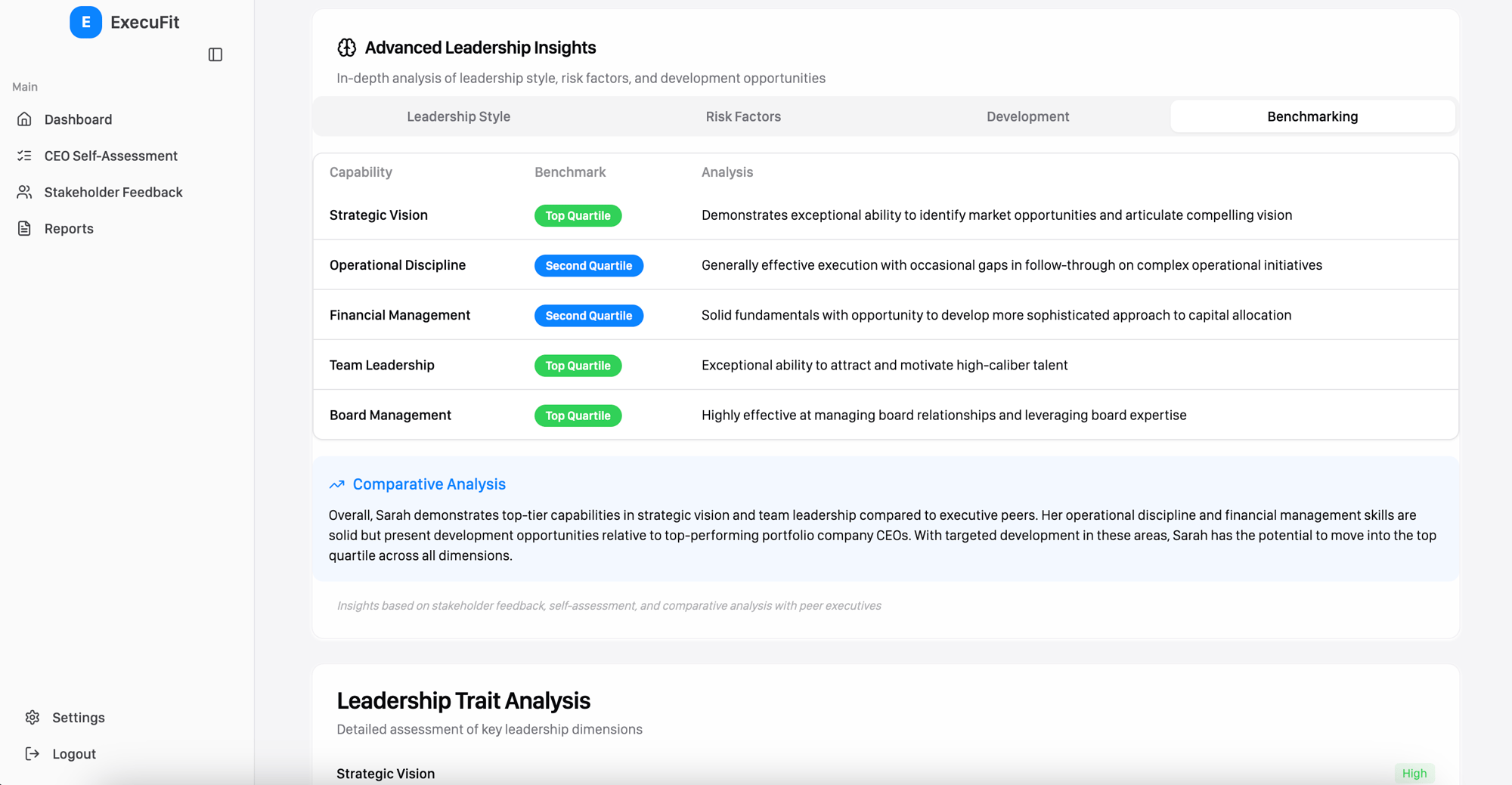

Benchmark

See how they benchmark vs other CEO's

-

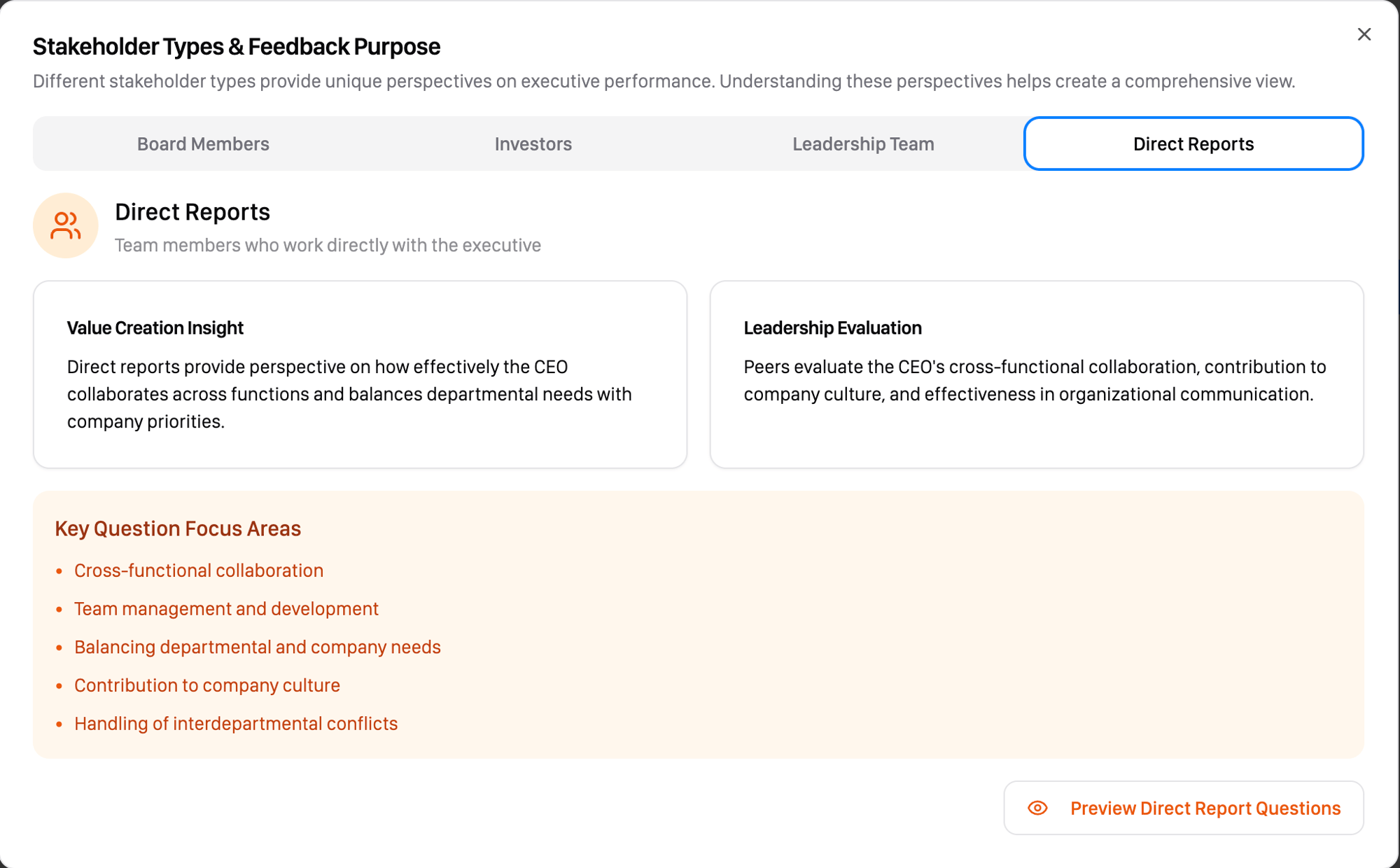

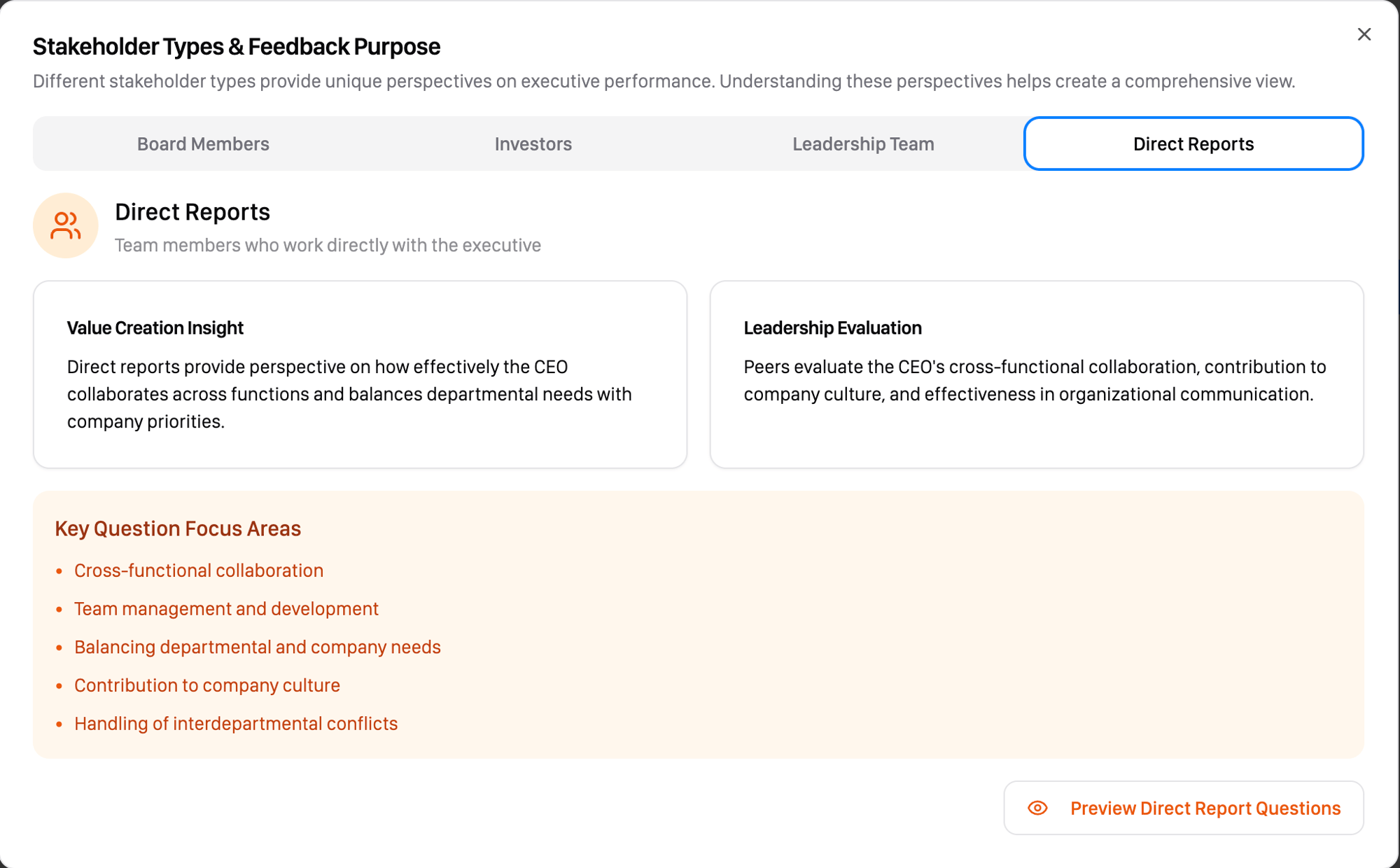

Stakeholders

Build a rounded picture with feedback from a variety of sources

Working with GIBUS is easy.

See our process

Phase 1

Align with Your Investment Thesis

We start by understanding your investment thesis, value creation plan, and portfolio goals. This ensures our due diligence is tailored to your deal priorities, with real-time tracking via our dashboard.

Phase 2

Spotlight the CEO

We conduct a PE-specific assessment of the leadership team, including a comprehensive evaluation of the CEO and key executives. Within one week, you’ll receive a detailed report benchmarking them against successful PE-backed leaders - also visible in your own dashboard.

Phase 3

Evaluate the Leadership Team

Next, we assess the broader management team through interviews and tailored evaluations, while HR completes a human capital assessment. All data is seamlessly integrated into the dashboard, giving you a complete view of the team’s capabilities and development needs.

Phase 4

Deliver Actionable Insights

We analyse all findings to produce a comprehensive report, highlighting key strengths, risks, and growth opportunities. This equips you with the insights needed to make a confident investment decision and sets the stage for post-deal success.

Phase 5

Plan for Immediate Impact

If you proceed with the investment, we use the diligence data to create a 100-day roadmap focused on high-impact initiatives that drive revenue and EBITDA from day one. This ensures your portfolio company starts strong and stays on track.

Phase 6

Partner for Long-Term Growth

We work alongside the portfolio company to execute the plan, track progress, and provide ongoing human capital support. We operate as their trusted partner, ensuring sustained growth throughout your investment.

Let's build together.

Meet with GIBUS

You ask, we answer

FAQs

What does your due diligence process evaluate?

We assess your CEO and leadership team’s capabilities, focusing on strengths, risks, and growth potential. Using AI-driven analytics and PE-specific benchmarks, we evaluate execution ability, strategic alignment, and team dynamics to ensure they can drive growth.

How long does the due diligence process take?

Our process is fast and efficient—you’ll get actionable insights on the CEO in under a week. We then dig deeper into the wider management team deliver a comprehensive report within 21 days, empowering you to make swift, confident decisions without delays.

How do you ensure the insights are actionable?

Our reports cut through the noise, focusing on what matters—key risks, strengths, and growth opportunities. We provide a 100-day roadmap and integrated data to align your team and investors, ensuring you can act on insights immediately to maximise returns.

How does your due diligence differ from traditional Management DD?

Unlike traditional DD, we focus on PE-specific leadership benchmarks and deliver rapid, actionable insights in under a week. Our AI-driven assessments and integrated data provide a clear view of risks and opportunities, tailored to your value creation plan.

What kind of leadership risks do you uncover?

We identify gaps in execution ability, strategic alignment, and team dynamics that could derail your growth plans. For example, we assess if the CEO can scale operations or if key executives lack the skills for your value creation strategy.